Protecting Your Business With Income Coverage

5/19/2022 (Permalink)

Why You Need Interruption Insurance

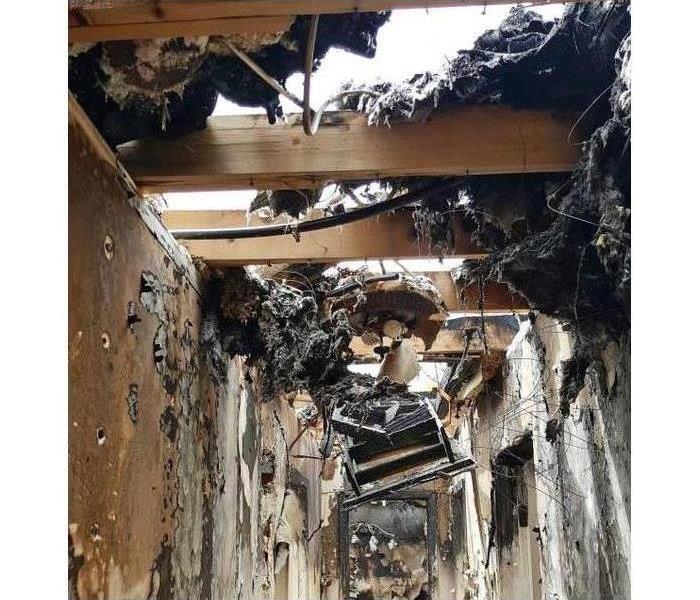

Responsible property owners carry property insurance. If you ever experience a fire in your building in Clyde, NC, your policy generally covers your expenses associated with repair, replacement, and reconstruction. With an insurance plan that covers physical damage to your property and its contents, you might think you’ve covered all your bases. How about the temporary loss of income? Here’s why you need interruption insurance as part of a comprehensive plan.

Understanding Business Interruption Coverage

Also known as business income insurance, this policy covers the loss of income you may experience following a fire or other disaster. This income loss may be due to the closing of your facility as a direct result of the fire or reconstruction during the fire restoration process. Interruption insurance is designed to cover the profits that you would’ve earned if you hadn’t incurred the loss that interrupted your business. A typical policy covers the following:

Profits: Usually based on previous monthly financial statements

Fixed costs: Operating expenses and costs that are still incurred

Temporary relocation: Covers costs of temporarily relocating to, and operating at another location

Commission and training: Costs associated with training workers to operate equipment replacements

Additional expenses: Other reasonable costs necessary for a business to continue operations during restoration

Civil authority ingress and egress: Government-mandated closures that result in loss of revenue, such as curfews

Your insurer determines the time period covered, usually from the date of disaster to the date that your property is restored to pre-disaster conditions.

Considering Your Options

Interruption insurance policies can be purchased either as standalone plans or part of a comprehensive package of a business owner’s policy. Some companies purchase a contingent policy that provides coverage if suppliers and customers experience damage that interferes with doing business. Think carefully about your specific needs as a commercial property owner.

Having a fire disaster plan is more than just property insurance and knowing which professional restoration services company to call. It’s also about having coverage that includes the loss of revenue or income after a disaster. This coverage protects your business, including customers, workers, and partners.

24/7 Emergency Service

24/7 Emergency Service